BLOG

Mortgage, Real Estate, and Entrepreneurship

From Loan Officer to Broker Owner: What you do as a Mortgage Broker

From Loan Officer to Broker Owner: What you do as a Mortgage Broker

When I joined the mortgage industry, I worked for 8 years as a loan officer at a small local owned mortgage brokerage, helping people buy homes, investment properties and refinance their existing mortgages. Being the overachiever I am, I quickly became the top producer, closing 10+ loans a month within my first 6 months in the role. I had no idea that this was not the norm in the industry.

I also was unaware that there are differences between working at a mortgage brokerage, a retail mortgage company and a bank. There were so many things that I was not exposed to or educated on during those first years in the mortgage business.

Now that I have spent more time working outside of that company, as a loan officer, mortgage broker owner, and sales manager at a retail lender, I can easily summarize what you do as a loan officer and business owner at a mortgage brokerage, and how these roles are similar and different to other industry opportunities.

One other clarification I want to make sure you understand is that of a loan officer versus a mortgage broker. These titles can be used interchangeably and at different company types.

Loan Officer- when you take the 20 Hour NMLS Pre Licensing course and pass the NMLS exam, you are now a licensed loan originator, aka Loan Officer. You will have to choose where you want to hang your license, and no matter if you choose to hang it at a local bank, a retail lender or a mortgage brokerage, you are still a loan officer at all three company types.

Mortgage Broker- is the name for an independent mortgage company, that does not lend their own money or underwrite loans. The loan officers that work at a mortgage brokerage will work with a handful to hundreds of lenders, when they are helping their clients find the best mortgage loan.

Mortgage Broker Owner- is the title of the licensed loan officer who has chosen to apply for, open and run an independent mortgage brokerage in their state. If you are a mortgage broker owner, you can choose which tasks and responsibilities you handle personally and which ones you assign to employees, but if you choose to become the owner of a mortgage brokerage, there are a number of responsibilities that now exist, that you didn’t have to worry about when you were simply a Loan Officer.

Mortgage Broker Roles & Responsibilities

No matter if you are a loan officer at a bank or mortgage brokerage, your overarching responsibilities are very similar

Mortgage Loan Officer Responsibilities (applies to LO’s at Banks, Retail Lenders & Mortgage Brokerages)

Meet with clients in person or over the phone

Take loan applications

Run and review credit reports

Calculate income

Issue Preapprovals

Shop lenders & loan programs

Lock interest rates

Disclose loans you have locked

Run underwriting systems

Turn loan files into Processing

Meet with your Processors weekly

Update Clients & Realtor Partners with the status of pending transactions

Prospecting for new business

Host presentations & lunch & Learns

Manage a loan pipeline

Put out fires

Mortgage Broker Owner Responsibilities

Where the differences begin to creep in is when and if you decide to become the owner of an Independent Mortgage Brokerage. Similar to any other small business that you could open, all tasks, departments and to-do’s are your responsibility to either complete or delegate. This can be a lot to handle if you are already closing a good number of loans monthly, so if this is you, you will want to come up with a plan on who you can assign to or hire to help with the following activities.

Manage Company & Loan Officer Licensing

Manage Company Compliance

Training & mentoring any Loan Officers who join your company/team

Finances & Bookkeeping

Signing up with Vendors and wholesale lenders

Marketing planning and delegation

All Human Resource activity, from:

New Hire documents

Onboarding

Hosting meetings

Choosing and offering benefits

Submitting payroll

Now, I want to be clear in that the 10 years of owning my own mortgage brokerage, I have not handled many of the items listed above, and that is because I choose to delegate them to other team members, while I focused on growth of my business.

Sales Leader & Producer

When opening a brokerage, you are most likely going to be the primary producing loan officer for some time. It is one of the reasons that loan officers have such a great opportunity to open and build their own business.

In most business models, the owners are starting from scratch, having to come up with a plan on how they will get customers and build a database. Loan Officers who are already originating loans at a different company can take their annual production and use it as a baseline to create a budget or pro forma when they are looking to open their own mortgage business.

If you are the only loan officer, it is important to keep this as your key role and priority, as this is the income that is going to keep your doors open and provide you with revenue that you can use to grow the business as you move forward,

This means you will have all the responsibilities listed above under the section labeled, “Mortgage Loan Officer Responsibilities”

If you hire a team or bring on loan officers, you will also need to:

Recruit loan officers

Work alongside processors

Update clients and realtor partners

Training for less experienced team members

Yearly and monthly goal setting

In addition to the three roles outlined above, you or someone on your team will need to oversee or perform yourself anything that falls under these additional categories:

Pipeline Management

Managing Vendors & Wholesale Lenders

NMLS Licensing Requirements & Filings

Compliance

Marketing

Human Resources

Chief Financial Officer

Now, these are just categories of the business. How many tasks that are involved with vary based on the number of loans you close, how many employees work at your mortgage brokerage and if you have enlisted help from others.

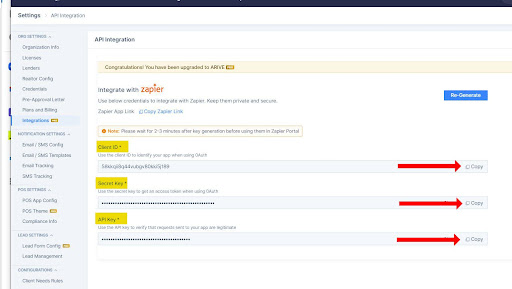

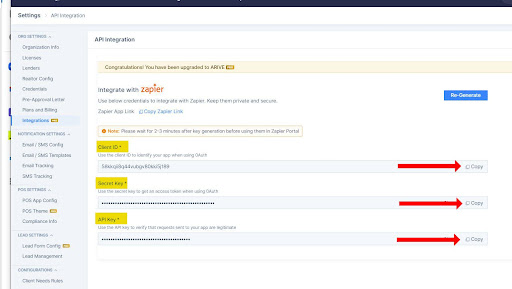

In our Broker FastTrack program and Franchise, we use a template called the Busy Bee Blueprint, where all the tasks and responsibilities of a mortgage broker are listed out, from launching and opening the brokerage to ongoing management. It allows our Mortgage Broker clients and partners to easily plan who will be doing what.

As a mortgage broker, the things you do outside and beyond what you do as a loan officer are business owner tasks and mortgage industry specific requirements to ensure you are complying with industry standards.

These activities are not rocket science, but you cannot overlook them. If your goal is to grow a mortgage brokerage, I suggest you hire someone to get these items completed and you focus on growing your business by selling, leading a team and recruiting.

If you would like to get access to our Mortgage Broker Busy Bee Blueprint shown in this post, tell us where to send it and we will give you a copy to try!

From Loan Officer to Broker Owner: What you do as a Mortgage Broker

From Loan Officer to Broker Owner: What you do as a Mortgage Broker

When I joined the mortgage industry, I worked for 8 years as a loan officer at a small local owned mortgage brokerage, helping people buy homes, investment properties and refinance their existing mortgages. Being the overachiever I am, I quickly became the top producer, closing 10+ loans a month within my first 6 months in the role. I had no idea that this was not the norm in the industry.

I also was unaware that there are differences between working at a mortgage brokerage, a retail mortgage company and a bank. There were so many things that I was not exposed to or educated on during those first years in the mortgage business.

Now that I have spent more time working outside of that company, as a loan officer, mortgage broker owner, and sales manager at a retail lender, I can easily summarize what you do as a loan officer and business owner at a mortgage brokerage, and how these roles are similar and different to other industry opportunities.

One other clarification I want to make sure you understand is that of a loan officer versus a mortgage broker. These titles can be used interchangeably and at different company types.

Loan Officer- when you take the 20 Hour NMLS Pre Licensing course and pass the NMLS exam, you are now a licensed loan originator, aka Loan Officer. You will have to choose where you want to hang your license, and no matter if you choose to hang it at a local bank, a retail lender or a mortgage brokerage, you are still a loan officer at all three company types.

Mortgage Broker- is the name for an independent mortgage company, that does not lend their own money or underwrite loans. The loan officers that work at a mortgage brokerage will work with a handful to hundreds of lenders, when they are helping their clients find the best mortgage loan.

Mortgage Broker Owner- is the title of the licensed loan officer who has chosen to apply for, open and run an independent mortgage brokerage in their state. If you are a mortgage broker owner, you can choose which tasks and responsibilities you handle personally and which ones you assign to employees, but if you choose to become the owner of a mortgage brokerage, there are a number of responsibilities that now exist, that you didn’t have to worry about when you were simply a Loan Officer.

Mortgage Broker Roles & Responsibilities

No matter if you are a loan officer at a bank or mortgage brokerage, your overarching responsibilities are very similar

Mortgage Loan Officer Responsibilities (applies to LO’s at Banks, Retail Lenders & Mortgage Brokerages)

Meet with clients in person or over the phone

Take loan applications

Run and review credit reports

Calculate income

Issue Preapprovals

Shop lenders & loan programs

Lock interest rates

Disclose loans you have locked

Run underwriting systems

Turn loan files into Processing

Meet with your Processors weekly

Update Clients & Realtor Partners with the status of pending transactions

Prospecting for new business

Host presentations & lunch & Learns

Manage a loan pipeline

Put out fires

Mortgage Broker Owner Responsibilities

Where the differences begin to creep in is when and if you decide to become the owner of an Independent Mortgage Brokerage. Similar to any other small business that you could open, all tasks, departments and to-do’s are your responsibility to either complete or delegate. This can be a lot to handle if you are already closing a good number of loans monthly, so if this is you, you will want to come up with a plan on who you can assign to or hire to help with the following activities.

Manage Company & Loan Officer Licensing

Manage Company Compliance

Training & mentoring any Loan Officers who join your company/team

Finances & Bookkeeping

Signing up with Vendors and wholesale lenders

Marketing planning and delegation

All Human Resource activity, from:

New Hire documents

Onboarding

Hosting meetings

Choosing and offering benefits

Submitting payroll

Now, I want to be clear in that the 10 years of owning my own mortgage brokerage, I have not handled many of the items listed above, and that is because I choose to delegate them to other team members, while I focused on growth of my business.

Sales Leader & Producer

When opening a brokerage, you are most likely going to be the primary producing loan officer for some time. It is one of the reasons that loan officers have such a great opportunity to open and build their own business.

In most business models, the owners are starting from scratch, having to come up with a plan on how they will get customers and build a database. Loan Officers who are already originating loans at a different company can take their annual production and use it as a baseline to create a budget or pro forma when they are looking to open their own mortgage business.

If you are the only loan officer, it is important to keep this as your key role and priority, as this is the income that is going to keep your doors open and provide you with revenue that you can use to grow the business as you move forward,

This means you will have all the responsibilities listed above under the section labeled, “Mortgage Loan Officer Responsibilities”

If you hire a team or bring on loan officers, you will also need to:

Recruit loan officers

Work alongside processors

Update clients and realtor partners

Training for less experienced team members

Yearly and monthly goal setting

In addition to the three roles outlined above, you or someone on your team will need to oversee or perform yourself anything that falls under these additional categories:

Pipeline Management

Managing Vendors & Wholesale Lenders

NMLS Licensing Requirements & Filings

Compliance

Marketing

Human Resources

Chief Financial Officer

Now, these are just categories of the business. How many tasks that are involved with vary based on the number of loans you close, how many employees work at your mortgage brokerage and if you have enlisted help from others.

In our Broker FastTrack program and Franchise, we use a template called the Busy Bee Blueprint, where all the tasks and responsibilities of a mortgage broker are listed out, from launching and opening the brokerage to ongoing management. It allows our Mortgage Broker clients and partners to easily plan who will be doing what.

As a mortgage broker, the things you do outside and beyond what you do as a loan officer are business owner tasks and mortgage industry specific requirements to ensure you are complying with industry standards.

These activities are not rocket science, but you cannot overlook them. If your goal is to grow a mortgage brokerage, I suggest you hire someone to get these items completed and you focus on growing your business by selling, leading a team and recruiting.

If you would like to get access to our Mortgage Broker Busy Bee Blueprint shown in this post, tell us where to send it and we will give you a copy to try!

Are You Ready...

to Start Building a Legacy and Not Just a Business?

AS FEATURED IN:

Co/LAB Corporate

8795 Peach Street,

Erie, PA 16509

Company

Resources

Learn more about who we are, what we do, and how we can help you by visiting our other company websites.

www.becomeamortgagebroker.info