BLOG

Mortgage, Real Estate, and Entrepreneurship

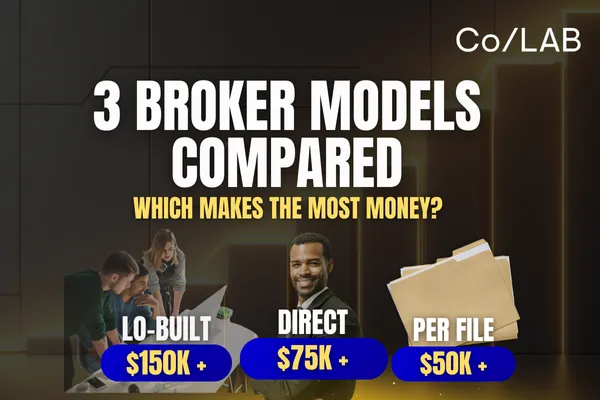

3 Proven Mortgage Broker Business Models (Which One Makes the Most Profit?)

3 Proven Mortgage Broker Business Models: How to Choose the Right One for Profitability

Starting or scaling a mortgage brokerage isn’t just about getting licensed, signing up with lenders, and opening the doors. The real success factor? Choosing the right business model from day one.

Here’s the truth: most mortgage brokerages don’t fail because of the market. They fail because their owners pick a business model that doesn’t align with their strengths, budget, or long-term goals. Pick the wrong one, and you could lose years of momentum and six figures in potential profit.

In this article, I’m breaking down the three proven mortgage broker business models that are working right now—including real numbers, pros and cons, and exactly who each model is best suited for.

Whether you’re a loan officer ready to break free or an entrepreneur eyeing the mortgage space, this breakdown will help you avoid costly mistakes and choose a model that sets you up for profitability.

Why Your Mortgage Broker Business Model Matters

Think of your business model as the engine of your brokerage. No matter how nice your “car” looks (office space, branding, team), if the engine doesn’t fit your driving style, you’re not going far.

The wrong model? It’s like putting a racecar engine into a family SUV—it burns out fast.

The right model? It gives you the balance of power, control, and efficiency to reach your goals.

Your model dictates:

How you’ll generate revenue

Who you’ll recruit (loan officers, sales teams, or independent agents)

How much you’ll spend on overhead

How quickly you’ll hit profitability

Let’s dig into the three options.

Model #1: The Traditional Loan Officer-Driven Brokerage

This is the classic mortgage brokerage model—and still one of the most popular.

How It Works

You, the broker-owner, start as the producing loan officer driving initial revenue.

Over time, you recruit additional loan officers to grow volume.

You provide the infrastructure: compliance, marketing, tech, processing, and support.

Loan officers are paid on a split (typically 75–155 basis points per loan).

Your profit comes from the spread between what you pay the loan officers and what lenders pay your company.

The Numbers

Startup costs: High—you’ll need staff, tech, CRM, compliance, and marketing.

Break-even timeline: 12–18 months (once you bring in 5–12 LOs).

Profit margin: 15–25% once established.

Who Wins Here

This model is ideal if you:

Love recruiting and managing teams.

Thrive on building culture and developing loan officers.

Don’t mind juggling different personalities.

Risks to Consider

Turnover risk is high. Lose one top-producing LO, and your revenue can plummet overnight.

You’re heavily dependent on your team’s performance—not just your own.

👉 In short: The traditional model is great for builders and recruiters, but it requires capital and patience to see returns.

Model #2: The Direct-to-Consumer Rainmaker Brokerage

If the traditional model is about team-building, this one is about you owning the pipeline.

How It Works

You, the owner, are the rainmaker—driving business through relationships, referrals, or marketing.

Instead of relying on LOs to bring in business, you control the leads.

Leads come from sources like:

Digital marketing campaigns

Zillow or lead list purchases

Referrals and repeat clients

Loan officers (or LOAs) are more like inside sales agents. They don’t hunt; they work the leads you provide.

Since you own the pipeline, their comp is lower—and your margins are higher.

The Numbers

Startup costs: Similar to Model #1, but your investment goes into lead generation systems (marketing or purchased leads).

Break-even timeline: Shorter, especially if you already have a book of business.

Profit margin: 30–40%—much higher since you’re paying LOs less.

Who Wins Here

Perfect for loan officers who are:

Proven rainmakers with strong referral networks.

Experienced in digital marketing and lead funnels.

Looking for maximum profit and control.

Risks to Consider

The business depends on you showing up. Step away, and the pipeline may dry up.

Managing overhead costs (staff, marketing spend) requires discipline.

If your leads stop converting, your profitability takes a hit.

👉 Bottom line: This is the “CEO as rainmaker” model. It gives you control and big profit margins—but only if you’ve built a reliable machine that can run even when you’re not in the driver’s seat.

Model #3: The Per-File (Lean) Brokerage Model

The newest and leanest of the three, this model prioritizes low overhead and high scalability.

How It Works

Loan officers function almost like independent contractors.

You provide only the essentials: licensing, payroll, lender relationships, and basic compliance.

Every closed loan generates a flat per-file fee (typically $595–$1,600 per file).

Loan officers pay for their own marketing, CRM, credit reports, and other expenses.

The Numbers

Startup costs: Low—about one-third to half of Models #1 and #2.

Break-even timeline: Fast—4–5 months with just a few active LOs.

Profit margin: Smaller per file (20–25%), but scalable with volume.

Who Wins Here

Best suited for:

Entrepreneurs who want to test the waters with low risk.

Brokers who don’t want to manage big teams or heavy overhead.

Those looking to scale by recruiting hundreds of independent LOs.

Risks to Consider

Less control over loan officer performance and client experience.

Profitability depends on volume, not margin—you need lots of LOs closing lots of loans.

👉 In short: The per-file model is the “lean startup” of mortgage brokerages—perfect for low-risk operators, but long-term profitability requires scale.

Side-by-Side Comparison: Which Model Fits You?

Choosing the Right Mortgage Broker Business Model

So, which model should you choose? The answer depends on three key factors:

Your Strengths – Are you a recruiter, a rainmaker, or a lean operator?

Your Capital – Do you have the upfront investment to build infrastructure or buy leads?

Your Risk Tolerance – Are you okay with slower returns for higher margins, or do you want quick breakeven with less control?

Remember: there’s no “wrong” model—just the wrong one for you. The most profitable brokerage isn’t always the one with the flashiest systems or the biggest team. It’s the one that fits your strengths and you can execute consistently.

Final Thoughts: Don’t Gamble on the Wrong Model

Starting a mortgage brokerage is one of the biggest career moves you can make. But the difference between thriving and just surviving comes down to your model.

Choose the traditional model if you’re a recruiter who loves building teams.

Choose the direct-to-consumer model if you’re a rainmaker ready to maximize profit.

Choose the per-file model if you want to start lean and scale over time.

👉 Ready to map out your business plan and avoid the six-figure mistakes most brokers make? Book a free strategy call with our team today, and let’s build the exact type of brokerage you’ve always dreamed of.

Frequently Asked Questions About Mortgage Broker Business Models

1. What is the most profitable mortgage broker business model?

The direct-to-consumer rainmaker model often delivers the highest profit margins (30–40%) because you control the leads and pay your loan officers a smaller share. But profitability also depends on your ability to consistently generate quality leads and manage expenses.

2. How much money do I need to start a mortgage brokerage?

Startup costs vary depending on the model:

Traditional LO-driven model: High, due to staffing, compliance, and marketing systems.

Direct-to-consumer model: Similar investment, but funds go into lead generation.

Per-file model: Lowest cost, often one-third of the traditional model.

👉 If you’re just starting, check out our step-by-step guide: How to Set Up a Mortgage Broker Business the Right Way.

3. How long until a mortgage brokerage becomes profitable?

Traditional model: 12–18 months

Direct-to-consumer: 6–12 months

Per-file model: 4–5 months

Break-even timelines depend on your ability to recruit loan officers (traditional), generate leads (direct-to-consumer), or scale headcount (per-file).

4. Which model is best for new mortgage brokers?

If you’re brand new, the per-file model is often the safest way to test the waters with low risk. However, if you already have a strong referral network or lead-generation system, the direct-to-consumer model may be more profitable long-term.

👉 For personalized guidance, consider booking a free mortgage broker strategy call.

5. What’s the biggest mistake new broker-owners make?

The #1 mistake is choosing a model that doesn’t align with their strengths, budget, or risk tolerance. For example:

Recruiters thrive in the traditional model.

Rainmakers succeed in direct-to-consumer.

Lean operators do well in per-file models.

Megan Marsh

CEO/ FOUNDER of Co/LAB Broker Concierge

In Case You Missed Our Previous Blogs & YouTube Videos..

Read Here: The Real Reasons Loan Officers Switch Mortgage Companies

This blog uncovers the real reasons loan officers switch mortgage companies and how to spot red flags before making a move. Megan Marsh shares insights from her experience helping hundreds of loan officers navigate company changes, revealing recruiter tricks, hidden fees, and the questions you need to ask to protect your income and career. Packed with real stories, practical strategies, and clear guidance, this article helps loan officers make informed decisions and avoid costly mistakes when considering a new opportunity.

Read Here: Break Through the Income Ceiling: Scale Your Mortgage Brokerage & LO Business

This blog explores why so many top-producing loan officers and broker owners hit an income ceiling—and how to break through it. From shifting out of a scarcity mindset, to outsourcing non-revenue tasks, to building scalable systems, you’ll learn the strategies that transform a hustle-driven job into a sustainable, profitable brokerage. If you’re ready to stop capping your income and start building a true business, this guide shows you how to scale smarter.

Mortgage Broker Support

Need help starting your mortgage business? Our Mortgage Broker Concierge Team is here to assist you!

If you’re curious about how we can help you simplify your operations beyond what our videos offer and want to know how you can make launching or running your brokerage stress-free, the link below explains everything. No fluff, no “exclusive training” gimmicks—just a straightforward way to see how we work with brokers to take backend tasks off their plates. Check it out here: https://colablendingfranchise.com/book-a-discovery-call

3 Proven Mortgage Broker Business Models (Which One Makes the Most Profit?)

3 Proven Mortgage Broker Business Models: How to Choose the Right One for Profitability

Starting or scaling a mortgage brokerage isn’t just about getting licensed, signing up with lenders, and opening the doors. The real success factor? Choosing the right business model from day one.

Here’s the truth: most mortgage brokerages don’t fail because of the market. They fail because their owners pick a business model that doesn’t align with their strengths, budget, or long-term goals. Pick the wrong one, and you could lose years of momentum and six figures in potential profit.

In this article, I’m breaking down the three proven mortgage broker business models that are working right now—including real numbers, pros and cons, and exactly who each model is best suited for.

Whether you’re a loan officer ready to break free or an entrepreneur eyeing the mortgage space, this breakdown will help you avoid costly mistakes and choose a model that sets you up for profitability.

Why Your Mortgage Broker Business Model Matters

Think of your business model as the engine of your brokerage. No matter how nice your “car” looks (office space, branding, team), if the engine doesn’t fit your driving style, you’re not going far.

The wrong model? It’s like putting a racecar engine into a family SUV—it burns out fast.

The right model? It gives you the balance of power, control, and efficiency to reach your goals.

Your model dictates:

How you’ll generate revenue

Who you’ll recruit (loan officers, sales teams, or independent agents)

How much you’ll spend on overhead

How quickly you’ll hit profitability

Let’s dig into the three options.

Model #1: The Traditional Loan Officer-Driven Brokerage

This is the classic mortgage brokerage model—and still one of the most popular.

How It Works

You, the broker-owner, start as the producing loan officer driving initial revenue.

Over time, you recruit additional loan officers to grow volume.

You provide the infrastructure: compliance, marketing, tech, processing, and support.

Loan officers are paid on a split (typically 75–155 basis points per loan).

Your profit comes from the spread between what you pay the loan officers and what lenders pay your company.

The Numbers

Startup costs: High—you’ll need staff, tech, CRM, compliance, and marketing.

Break-even timeline: 12–18 months (once you bring in 5–12 LOs).

Profit margin: 15–25% once established.

Who Wins Here

This model is ideal if you:

Love recruiting and managing teams.

Thrive on building culture and developing loan officers.

Don’t mind juggling different personalities.

Risks to Consider

Turnover risk is high. Lose one top-producing LO, and your revenue can plummet overnight.

You’re heavily dependent on your team’s performance—not just your own.

👉 In short: The traditional model is great for builders and recruiters, but it requires capital and patience to see returns.

Model #2: The Direct-to-Consumer Rainmaker Brokerage

If the traditional model is about team-building, this one is about you owning the pipeline.

How It Works

You, the owner, are the rainmaker—driving business through relationships, referrals, or marketing.

Instead of relying on LOs to bring in business, you control the leads.

Leads come from sources like:

Digital marketing campaigns

Zillow or lead list purchases

Referrals and repeat clients

Loan officers (or LOAs) are more like inside sales agents. They don’t hunt; they work the leads you provide.

Since you own the pipeline, their comp is lower—and your margins are higher.

The Numbers

Startup costs: Similar to Model #1, but your investment goes into lead generation systems (marketing or purchased leads).

Break-even timeline: Shorter, especially if you already have a book of business.

Profit margin: 30–40%—much higher since you’re paying LOs less.

Who Wins Here

Perfect for loan officers who are:

Proven rainmakers with strong referral networks.

Experienced in digital marketing and lead funnels.

Looking for maximum profit and control.

Risks to Consider

The business depends on you showing up. Step away, and the pipeline may dry up.

Managing overhead costs (staff, marketing spend) requires discipline.

If your leads stop converting, your profitability takes a hit.

👉 Bottom line: This is the “CEO as rainmaker” model. It gives you control and big profit margins—but only if you’ve built a reliable machine that can run even when you’re not in the driver’s seat.

Model #3: The Per-File (Lean) Brokerage Model

The newest and leanest of the three, this model prioritizes low overhead and high scalability.

How It Works

Loan officers function almost like independent contractors.

You provide only the essentials: licensing, payroll, lender relationships, and basic compliance.

Every closed loan generates a flat per-file fee (typically $595–$1,600 per file).

Loan officers pay for their own marketing, CRM, credit reports, and other expenses.

The Numbers

Startup costs: Low—about one-third to half of Models #1 and #2.

Break-even timeline: Fast—4–5 months with just a few active LOs.

Profit margin: Smaller per file (20–25%), but scalable with volume.

Who Wins Here

Best suited for:

Entrepreneurs who want to test the waters with low risk.

Brokers who don’t want to manage big teams or heavy overhead.

Those looking to scale by recruiting hundreds of independent LOs.

Risks to Consider

Less control over loan officer performance and client experience.

Profitability depends on volume, not margin—you need lots of LOs closing lots of loans.

👉 In short: The per-file model is the “lean startup” of mortgage brokerages—perfect for low-risk operators, but long-term profitability requires scale.

Side-by-Side Comparison: Which Model Fits You?

Choosing the Right Mortgage Broker Business Model

So, which model should you choose? The answer depends on three key factors:

Your Strengths – Are you a recruiter, a rainmaker, or a lean operator?

Your Capital – Do you have the upfront investment to build infrastructure or buy leads?

Your Risk Tolerance – Are you okay with slower returns for higher margins, or do you want quick breakeven with less control?

Remember: there’s no “wrong” model—just the wrong one for you. The most profitable brokerage isn’t always the one with the flashiest systems or the biggest team. It’s the one that fits your strengths and you can execute consistently.

Final Thoughts: Don’t Gamble on the Wrong Model

Starting a mortgage brokerage is one of the biggest career moves you can make. But the difference between thriving and just surviving comes down to your model.

Choose the traditional model if you’re a recruiter who loves building teams.

Choose the direct-to-consumer model if you’re a rainmaker ready to maximize profit.

Choose the per-file model if you want to start lean and scale over time.

👉 Ready to map out your business plan and avoid the six-figure mistakes most brokers make? Book a free strategy call with our team today, and let’s build the exact type of brokerage you’ve always dreamed of.

Frequently Asked Questions About Mortgage Broker Business Models

1. What is the most profitable mortgage broker business model?

The direct-to-consumer rainmaker model often delivers the highest profit margins (30–40%) because you control the leads and pay your loan officers a smaller share. But profitability also depends on your ability to consistently generate quality leads and manage expenses.

2. How much money do I need to start a mortgage brokerage?

Startup costs vary depending on the model:

Traditional LO-driven model: High, due to staffing, compliance, and marketing systems.

Direct-to-consumer model: Similar investment, but funds go into lead generation.

Per-file model: Lowest cost, often one-third of the traditional model.

👉 If you’re just starting, check out our step-by-step guide: How to Set Up a Mortgage Broker Business the Right Way.

3. How long until a mortgage brokerage becomes profitable?

Traditional model: 12–18 months

Direct-to-consumer: 6–12 months

Per-file model: 4–5 months

Break-even timelines depend on your ability to recruit loan officers (traditional), generate leads (direct-to-consumer), or scale headcount (per-file).

4. Which model is best for new mortgage brokers?

If you’re brand new, the per-file model is often the safest way to test the waters with low risk. However, if you already have a strong referral network or lead-generation system, the direct-to-consumer model may be more profitable long-term.

👉 For personalized guidance, consider booking a free mortgage broker strategy call.

5. What’s the biggest mistake new broker-owners make?

The #1 mistake is choosing a model that doesn’t align with their strengths, budget, or risk tolerance. For example:

Recruiters thrive in the traditional model.

Rainmakers succeed in direct-to-consumer.

Lean operators do well in per-file models.

Megan Marsh

CEO/ FOUNDER of Co/LAB Broker Concierge

In Case You Missed Our Previous Blogs & YouTube Videos..

Read Here: The Real Reasons Loan Officers Switch Mortgage Companies

This blog uncovers the real reasons loan officers switch mortgage companies and how to spot red flags before making a move. Megan Marsh shares insights from her experience helping hundreds of loan officers navigate company changes, revealing recruiter tricks, hidden fees, and the questions you need to ask to protect your income and career. Packed with real stories, practical strategies, and clear guidance, this article helps loan officers make informed decisions and avoid costly mistakes when considering a new opportunity.

Read Here: Break Through the Income Ceiling: Scale Your Mortgage Brokerage & LO Business

This blog explores why so many top-producing loan officers and broker owners hit an income ceiling—and how to break through it. From shifting out of a scarcity mindset, to outsourcing non-revenue tasks, to building scalable systems, you’ll learn the strategies that transform a hustle-driven job into a sustainable, profitable brokerage. If you’re ready to stop capping your income and start building a true business, this guide shows you how to scale smarter.

Mortgage Broker Support

Need help starting your mortgage business? Our Mortgage Broker Concierge Team is here to assist you!

If you’re curious about how we can help you simplify your operations beyond what our videos offer and want to know how you can make launching or running your brokerage stress-free, the link below explains everything. No fluff, no “exclusive training” gimmicks—just a straightforward way to see how we work with brokers to take backend tasks off their plates. Check it out here: https://colablendingfranchise.com/book-a-discovery-call

Are You Ready...

to Start Building a Legacy and Not Just a Business?

AS FEATURED IN:

Co/LAB Broker Services Corporate

8795 Peach Street, Erie, PA 16506

Company

Resources

Learn more about who we are, what we do, and how we can help you by visiting our other company websites.